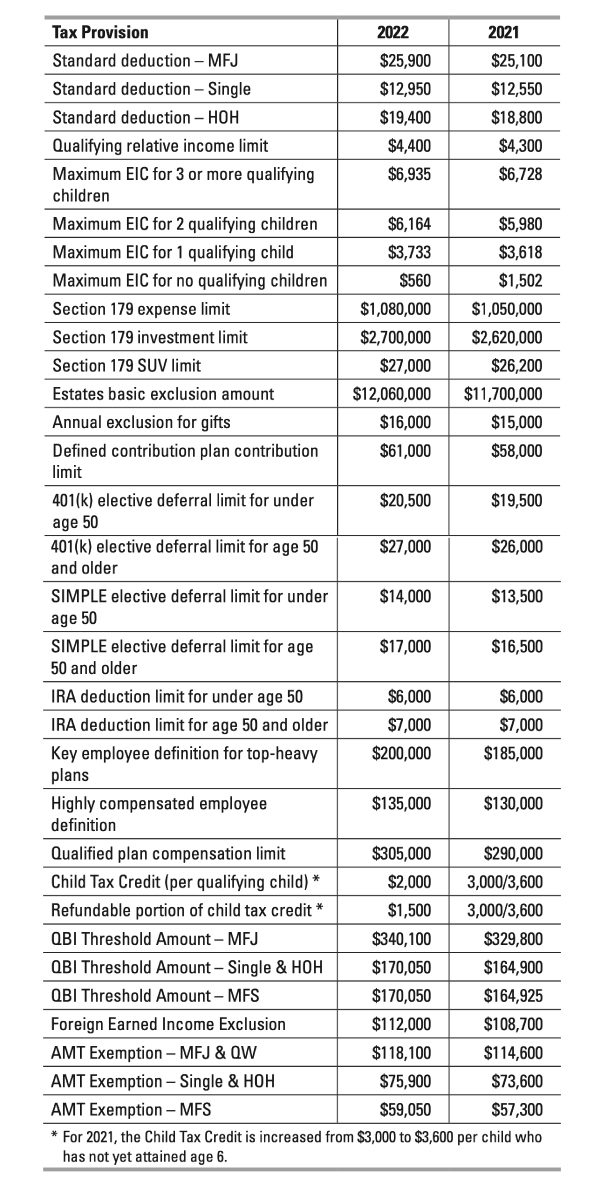

Inflation Adjusted Amounts

The following chart highlights a number of these adjustments, as they compare to the 2021 amounts.

IRS Encourages e-File and Direct Deposit

The IRS kicked off the 2022 tax filing season by encour- aging taxpayers to e-file and request a direct deposit for their refunds. At a news conference, IRS Commissioner Chuck Rettig said: “This could be a very frustrating fil- ing season for both taxpayers and tax professionals.” He noted that the IRS still lacks the resources to meet the needs of taxpayers. He emphasized three steps taxpayers should take:

- File electronically

- File accurately

- Request a direct deposit of refunds.

Note: The IRS has not yet finished processing paper tax returns for 2020. Some taxpayers who filed paper tax re- turns for 2020 with a balance due are receiving CP80 let- ters from the IRS showing a credit balance and claiming that the IRS has not yet received their tax return. In oth- er words, the IRS cashed the check but has yet to pro- cess the return, even though the check was in the same envelope as the paper tax return. A problem that could have been avoided had the return been e-filed.

The IRS expects more than 160 million individual tax returns for the 2021 tax year to be filed, most before the April 18, 2022 tax deadline. Rettig noted that taxpayers need to take special care this year due to several criti- cal tax law changes that took place in 2021 and ongoing challenges related to the pandemic.

“IRS employees are working hard to deliver a successful 2022 tax season while facing enormous challenges relat- ed to the pandemic,” Rettig said. “There are important steps people can take to ensure they avoid processing delays and get their tax refund as quickly as possible. We urge people to carefully review their taxes for ac- curacy before filing. And they should file electronically with direct deposit if at all possible; filing a paper tax re- turn this year means an extended refund delay.”

For most taxpayers who file a tax return with no issues, the IRS anticipates they will receive their refund with- in 21 days of when they file electronically if they choose direct deposit—similar to previous years. Last year’s av- erage tax refund was more than $2,800.

Child and Dependent Care Expense Credit

Charitable Contributions

The charitable contribution deduction for individuals who do not itemize deductions was extended to 2021. The deduction is $600 on a married filing joint return or $300 for all other returns. The deduction is limited to cash contributions.

Things to do in 2022 that can affect 2021 taxes

There is very little that you can do to impact your 2021 taxes after December 31, 2021. However, two things that can be done, if you qualify, is making a contribution to your traditional IRA and/or your health savings account (HSA).

IRA Deduction

For 2021, you may be able to contribute up to $6,000 ($7,000 if you are at least 50 years old) to an IRA. Contributions for 2021 can be made up until April 18, 2022. If the contribution is made to a traditional IRA, you may qualify for a deduction on your 2021 return. There is no age limit on making a contribution to traditional IRA or Roth IRA. In addition, contributions to any type of IRA (traditional or ROTH), might qualify you for the Retirement Savings Contribution Credit.

HSA Deduction

IRS Hot Items

There always seems to be a number of items that the IRS is focusing on. Some of the current topics the IRS is focused on are foreign assets, cryptocurrency transactions, and unreported income.

Foreign Assets

Cryptocurrency Transactions

Cryptocurrency (i.e. Bitcoin, Ethereum, etc.) is becoming more and more common.Transactions involving cryptocurrency have tax implications.The IRS requires anyone filing a tax return to answer the following question. “At any time during 2021, did you receive, sell, exchange, or other acquire any financial interest in any virtual currency?”

Unreported Income

If you are making extra money by doing side jobs, be it driving for a ridesharing com- pany such as Uber or Lyft, selling crafts on Etsy, delivering meals with Grubhub or DoorDash, renting out a room in your house via Airbnb, or any other way, it needs to be included on your tax return. Unless specifically excluded under the Internal Revenue Code, all income is taxable. This includes income that is not reported to you on one of the various Forms 1099, foreign income, and barter income.

Federal & State Differences

When it comes to taxes, most of what you read and hear from the media has to do with federal tax law. Remember that each state has its own tax law and just because something is not allowed for federal taxes (or you do not qualify) does not mean that you are not able to include it on your state tax return.